Audit Committee The Audit Committee has the most direct and systematic responsibility for overseeing risk management. The Audit Committee charter provides for a variety of regular and recurring responsibilities relating to risk, including: • having responsibility for the internal audit function, with that function having a direct line of communication to the Audit Committee; • receiving reports from management and the internal audit function regarding the adequacy and effectiveness of various internal controls; • reviewing periodically with internal counsel legal and regulatory matters that could have a significant impact on us and could indicate emerging areas of risk; • overseeing accounting and risk management processes, including receiving regular reports from our Chief Legal Officer; and • discussing with management our guidelines and policies with respect to risk assessment and enterprise risk management, including our major risk exposures and the steps management has taken to monitor and control such exposures. In performing these functions, the Audit Committee regularly receives reports from management (including the Chief Executive Officer, the Chief Financial Officer, the Controller and the Chief Legal Officer) and internal auditors regarding our risk management program (which incorporates our compliance, information & cyber security, and business continuity programs), extraordinary claims and losses, and significant litigation. The Board receives updates on risk oversight from the Audit Committee and members of management. | | Compensation Committee The Compensation Committee oversees our compensation policies and practices and has assessed whether our compensation policies encourage excessive risk-taking. The Compensation Committee has concluded that these policies and practices are not reasonably likely to have a material adverse effect on us. In arriving at that conclusion, the Compensation Committee considered, among other factors: Although risk oversight permeates many elements of the work of the full Board and the committees, the Audit Committee has the most direct and systematic responsibility for overseeing risk management. The Audit Committee charter provides for a variety of regular and recurring responsibilities relating to risk, including:

- •

having responsibility for the internal audit function, with that function having a direct line of communication to the Audit Committee;

•receiving reports from management and the internal audit function regarding the adequacy and effectiveness of various internal controls;

•reviewing periodically with internal counsel legal and regulatory matters that could have a significant impact on us and could indicate emerging areas of risk;

•overseeing our risk program with respect to legal and regulatory requirements and risks, including receiving regular reports from our Chief Risk Officer; and

•discussing with management our guidelines and policies with respect to risk assessment and risk management, including our major risk exposures and the steps management has taken to monitor and control such exposures.

In performing these functions, the Audit Committee regularly receives reports from management (including the Chief Executive Officer, the Chief Financial Officer, the Controller, the General Counsel and the Chief Risk Officer) and internal auditors regarding our risk management program (including our compliance

Table of Contents

program, information security and business continuity programs), extraordinary claims and losses, and significant litigation.

Separately, the Compensation Committee oversees our compensation policies and practices and has assessed whether our compensation policies encourage excessive risk taking. The Compensation Committee has concluded that these policies and practices are not reasonably likely to have a material adverse effect on us. In arriving at that conclusion, the Compensation Committee considered, among other factors, the metrics used to determine variable compensation;

• the portion of variable compensation paid in equity, which is either time-vested or tied to the achievement of long-term Company objectives; • the amount of compensation paid as sales commissions and the number of people to whom such compensation is paid; and • controls, such as pricing limits, a recoupment policy and financial reconciliation processes for sales crediting, quality checks that we employ and the approval process for certain compensation-related activities.

Board Meetings and Attendance

|

Board Meetings and Attendance Our Board held six meetings during 2016.2019 and ournon-management directors also met six times in executive session without management present. Each director attended 75% or more of the total number of meetings of the Board and meetings of the committees (if any) on which the director served during his or her respective tenure on the Board.Board during 2019. From time to time, our Board and committees also actsact by unanimous written consent as permitted by our Bylaws and the Delaware General Corporation Law.

Director Attendance at Annual Meetings We encourage our directors to attend the annual meetings of our stockholders, either in person or telephonically. All directors attended the 2019 annual meeting (with the exception of Mr. Shepherd, who was appointed to the Board in June 2019). Retention of Outside Advisors |

The Board and all of its committees have authority to retain outside advisors and consultants that they consider necessary or appropriate in carrying out their respective responsibilities. The independent accountants are retained by, and report directly to, the Audit Committee. In addition, the Audit Committee is responsible for the selection, assessment, and termination of the internal auditors to which we have outsourced our internal audit function. Similarly, the consultant retained by the Compensation Committee to assist in the evaluation of senior executive compensation reports directly to that committee. Code of Conduct The Board has adopted a codeCode of ethicsConduct (the “Code”) that applies to all employees, including our principal executive officer, principal financial officer, principal accounting officer or controller,directors, Chief Executive Officer, Chief Financial Officer, Controller, and persons performing similar functions. A copy of this code of ethics is posted on the Investors section of our web site under Leadership & Governance — Highlights atwww.corelogic.com. The Board also has adopted a broader code of ethics and conduct, applying to all employees, officers and directors,functions, which also has been posted under "Investors — Leadership“Investors-Leadership & Governance — Highlights"Governance-Highlights” on our web site at the address stated above.websitewww.corelogic.com. If we waive or amend any provisions of these codes of ethicsthe Code that apply to our directors and executive officers, including our principal executive officer, principal financial officer, principal accounting officer, or controllerChief Executive Officer, Chief Financial Officer, Controller and persons performing similar functions, we will disclose such waivers or amendments on our web site,website, at the address and location specified above, to the extent required by applicable SEC and NYSE Rules.rules. Corporate Governance Guidelines Corporate Governance Guidelines

|

The Board has adopted Corporate Governance Guidelines which have been posted under “Investors-Leadership & Governance-Highlights” on the Investors section of our web site under Leadership & Governance — Highlights atwebsitewww.corelogic.com. In addition to stating the standards that the Board applies in determining whether or not its members are independent, these guidelines stateaddress, among other items, the qualifications and responsibilities of our directors and describe fundamental aspects of our Board and certain of its committees.

Table of ContentsDirector Overboarding Policy

Director Overboarding Policy

|

Our Corporate Governance Guidelines provide that our directors may not serve on more than five public company boards (including our Board), and our Audit Committee members may not serve on more than three public company audit committees (including our Audit Committee), in each case, without prior Board approval. In each case, in determining whether to grant such approval, the Board will consider the director'sdirector’s ability to devote sufficient time to the activities of the Board and/or Audit Committee and the director'sdirector’s qualifications and contribution, or potential contribution, to the Board and/or Audit Committee. AllAs of the date of this proxy statement, all of our directors are in compliance with the overboarding policy. Board and Committee Evaluations Board and Committee Evaluations

|

To increase their effectiveness, the Board and each of its committees perform an annual self-evaluation under the direction of the Nominating and Corporate Governance Committee. The evaluation addresses, among other items, attendance, preparedness, participation, candor and other measures of performance selected by the Board.

Director Attendance at Annual Meetings

|

We encourage our directors to attend the annual meetings of our stockholders, either in person or telephonically. All of our nine directors nominated for election in 2017 attended the 2016 annual meeting.

Communicating with Directors Communicating with Directors

|

Stockholders and other interested parties may communicate directly with members of the Board, including the Chairman of the Board or any of the othernon-management directors of our Company (individually or as a group), by writing to such director(s) at: Our Corporate Secretary reviews and promptly forwards communications to the directors, as appropriate. Communications involving substantive accounting or auditing matters are forwarded to the Chair of the Audit Committee. Certain items that are unrelated to the duties and responsibilities of the Board will not be forwarded such as: business solicitation or advertisements; product- or service-related inquires; junk mail or mass mailings; resumes or otherjob-related inquires; and spam and overlyinappropriately hostile, threatening, potentially illegal or similarly unsuitable communications. Directors receiving communications will respond as such directors deem appropriate, including the possibility of referring the matter to management of our Company, to the full Board or to an appropriate committee of the Board. Transactions with Management and Others Transactions with Management and Others

|

The Board has adopted a written policy regarding transactions with related persons that requires the approval or ratification by the Board or the Nominating and Corporate Governance Committee of any transaction exceeding $120,000 in which we are a participant and any related person has a direct or indirect material interest. A related person includes a director, nominee for election as a director, executive officer, person controlling over 5% of our common stock and the immediate family members of each of these individuals. Once a transaction has been determined to require approval, the transaction will be reviewed and approved by either the Board or the Nominating and Corporate Governance Committee. The Board or the Nominating and Corporate Governance Committee will review and consider the terms, business purpose and benefits of the transaction to usthe Company and the related person.

Table of Contents

If a related party transaction is notpre-approved, then it must be brought to the Board or the Nominating and Corporate Governance Committee for ratification as promptly as possible. No member of the Board or the Nominating and Corporate Governance Committee may participate in the review or approval of a related party transaction in which he or she has a direct or indirect interest, unless the Chairman of the Board or the chairperson of the Nominating and Corporate Governance Committee requests such individual to participate. The following types of transactions do not requirepre-approval: •compensatory arrangements for service as an officer or director of ours, provided such compensation is approved by the Compensation Committee;

•transactions between us and our affiliates (other than directors and officers);

•transactions involving a related person with only an indirect interest resulting solely from ownership of less than 10% of, or being a director of, the entity entering into a transaction with us;

•ordinary course transactions involving annual payments of $100,000 or less; or

•transactions involving indebtedness between us and a beneficial owner of more than 5% of our common stock or an immediate family member of such beneficial owner, provided that the beneficial owner or family member is not an executive officer, director or director nominee of ours or an immediate family member thereof. We have entered into the transactions discussed below, which have been approved or ratified in accordance with ourIn fiscal 2019, there were no related party transactions policy.

Price Associates beneficially owns greater than 5% of our common stock and is therefore a related party. During 2016, Price Associates or its affiliates purchased approximately $208,000 of data, analytics and other Company products. These transactions occurredrequired to be disclosed pursuant to contracts entered into on an arm's-length basisItem 404 of RegulationS-K.

Anti-Hedging and were ratified by the Nominating and Corporate Governance Committee in accordance with our related party transactions policy.Pledging Policy BlackRock, Inc. beneficially owns greater than 5% of our common stock and is therefore a related party. During 2016, BlackRock, Inc. or its affiliates purchased approximately $395,000 of data, analytics and other Company products. These transactions occurred pursuant to contracts entered into on an arm's-length basis and were ratified by the Nominating and Corporate Governance Committee in accordance with our related party transactions policy.

Table of Contents

The following table sets forth certain information concerning the compensation of our directors other than Mr. Martell for the fiscal year ended December 31, 2016.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Name |

| | |

| Fees Earned or

Paid in Cash

($) |

| | |

| Stock

Awards(1)(2)

($) |

| | |

| Total

($) |

| | | | | | | | | | | | | | | | | | | | | | | | | | J. David Chatham | | | | | 122,000 | | | | | 121,519 | | | | | 243,519 | | | | | | Douglas C. Curling | | | | | 95,000 | | | | | 121,519 | | | | | 216,519 | | | | | | John C. Dorman | | | | | 100,000 | | | | | 121,519 | | | | | 221,519 | | | | | | Paul F. Folino | | | | | 207,000 | | | | | 121,519 | | | | | 328,519 | | | | | | Thomas C. O'Brien | | | | | 104,500 | | | | | 121,519 | | | | | 226,019 | | | | | | Jaynie Miller Studenmund | | | | | 94,500 | | | | | 121,519 | | | | | 216,019 | | | | | | David F. Walker | | | | | 112,500 | | | | | 121,519 | | | | | 234,019 | | | | | | Mary Lee Widener | | | | | 82,500 | | | | | 121,519 | | | | | 204,019 | | | | | | | | | | | | | | | | | | | | | | | |

(1)The amounts shown reflect the aggregate grant date fair value of stock awards granted in 2016, computed in accordance with the Financial Accounting Standards Board's Accounting Standards Codification Topic 718, Compensation-Stock Compensation. We value the RSUs as of the grant date by multiplying the closing price of our common stock on that date by the number of RSUs awarded. The stock awards were granted to each non-management director on April 27, 2016.

(2)The aggregate numbers of RSUs held by each current non-management director as of December 31, 2016 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | Name

|

| | |

| Restricted Stock Unit

Awards (#)

|

| | | | | | | | | | | | | | | | | | J. David Chatham | | | | | 3,760 | | | | | | | Douglas C. Curling | | | | | 3,760 | | | | | | | John C. Dorman | | | | | 3,760 | | | | | | | Paul F. Folino | | | | | 3,760 | | | | | | | Thomas C. O'Brien | | | | | 3,760 | | | | | | | Jaynie Miller Studenmund | | | | | 3,760 | | | | | | | David F. Walker | | | | | 3,760 | | | | | | | Mary Lee Widener | | | | | 3,760 | | | | | | | | | | | | | | | | |

The Compensation Committee reviews and recommends to the Board the form and level of director compensation. In March 2016, the Compensation Committee reviewed and recommended to the Board a new Directors' Compensation Policy that memorialized the current compensation paid by the Company to its non-management directors and included a deferral feature that permits non-management directors to elect to defer the receipt of their annual RSU awards until the earlier of termination of their Board service or a change in control of the Company. The Board approved and adopted the Directors' Compensation Policy in April 2016.

As described in the Compensation Discussion and Analysis, Pay Governance served as independent compensation consultant for the Compensation Committee for 2016 and will continue to advise on the compensation of our directors for 2017. During 2016, as part of its engagement with the Committee, Pay Governance:

•provided advice on the selection of a peer group of companies for director compensation comparison purposes;

Table of Contents

•provided guidance on industry best practices and emerging trends and developments in director compensation;

•provided input on the design of the deferral program in the Directors' Compensation Policy;

•reviewed director compensation;

•analyzed pay survey data; and

•provided advice on determining the structure and amounts payable under our director compensation program.

The table below describes the components of the non-management director compensation program in effect during 2016. No changes have been made to the non-management director compensation program for 2017.

| | | | | | | | | | | | | | | | | | | | Compensation Element |

|

| 2016 |

| | | | | | | | | | | | | | Annual Retainer — Non-Management Director (1) | | $ | 70,000 | | | | | | Annual Equity Compensation — RSUs (2) | | $ | 135,000 | | | | | | Annual Retainer — Non-Management Board Chairman | | $ | 100,000 | | | | | | Annual Retainer — Committee Chairs (1) | | | | | | | | | Audit Committee | | $ | 25,000 | | | | | | Compensation Committee | | $ | 20,000 | | | | | | Nominating and Corporate Governance Committee | | $ | 15,000 | | | | | | Acquisition and Strategic Development Committee (3) | | $ | 12,500 | | | | | | Annual Retainer — Committee Members (1) | | | | | | | | | Audit Committee | | $ | 12,500 | | | | | | Compensation Committee | | $ | 10,000 | | | | | | Talent Development Committee (3) | | $ | 12,500 | | | | | | Nominating and Corporate Governance Committee | | $ | 7,500 | | | | | | Acquisition and Strategic Development Committee (3) | | $ | 5,000 | | | | | | Insurance Strategy Subcommittee (3) | | $ | 12,500 | | | | | | Fee for attendance of Board and Committee Meetings in Excess of Designated Number (4) | | $ | 2,000 | | | | | | | | | | | |

(1)Committee chair retainer represents amounts paid to each committee chair for their service in addition to the committee member annual retainer. Paid in cash in equal quarterly installments. Paid pro rata for directors joining the Board after the payment date.

(2)The award is granted and priced on the day of our annual meeting or, in the event of an out-of-cycle annual meeting such earlier date as may be approved by the Board, and vest on the first anniversary of the grant date. Vesting of the award will accelerate upon death, disability, retirement from the Board or a change in control.

(3)The insurance strategy subcommittee to the Acquisition and Strategic Planning Committee and the talent development subcommittee to the Compensation Committee were created in March 2015.

(4)Meeting fees paid only for meetings in excess of eight meetings of the Board, Audit and Compensation committees, and in excess of four meetings of the Nominating and Corporate Governance and Acquisition and Strategic Planning committees. Fees are paid in cash in connection with each such additional meeting.

Table of Contents

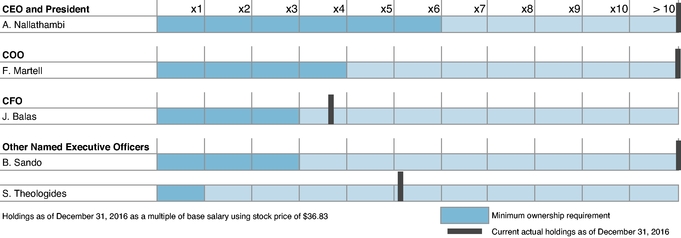

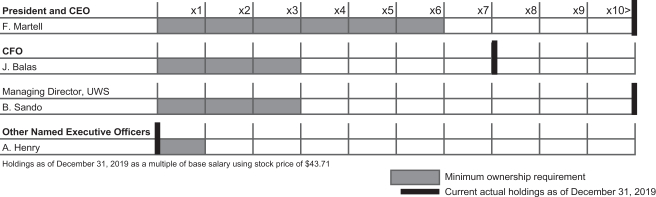

Director Share Ownership Guidelines

|

We require our non-management directors to own a fixed amount of Company stock. The guidelines are based on a multiple of the annual retainer, and require a value of at least $350,000 be held by each director. Directors have five years from their date of election to the Board to reach the ownership requirement. All Company securities owned outright or earned and subject only to time-based vesting restrictions count toward the requirement.

Anti-Hedging and Pledging Policy

|

The Company maintainsmaintain a policy that prohibits directorrestricts our directors, executive officers and other employees from engaging in hedging or monetization transactions, including prepaid variable forwards, equity swaps, collars and exchange funds, that may permit continued ownership of Company securities obtained through employee benefit plans or otherwise, but without the full risks and rewards of ownership. Pursuant to our policy, we also prohibit our directors, executive officers and other employees from engaging in transactions in put options, call options or other derivative securities, on an exchange or in any other organized market, as well as holding Company securities in a margin account or otherwise pledging Company securities as collateral for a loan.loan (except in limited circumstances if the person pledging the securities is able to demonstrate that he or she has the financial capacity to repay the loan without resort to the pledged securities). No such exception is currently in place.

DIRECTOR COMPENSATION The following table sets forth certain information concerning the compensation of our directors other than Mr. Martell for the fiscal year ended December 31, 2019. | | | | | | | | | | | | | Name | | Fees Earned or Paid in Cash ($) | | | Stock Awards (1)(2) ($) | | | Total ($) | | | | | | J. David Chatham | | $ | 133,803 | | | $ | 159,963 | | | $ | 293,766 | | | | | | Douglas C. Curling | | $ | 92,500 | | | $ | 159,963 | | | $ | 252,463 | | | | | | John C. Dorman | | $ | 112,500 | | | $ | 159,963 | | | $ | 272,463 | | | | | | Paul F. Folino | | $ | 217,500 | | | $ | 159,963 | | | $ | 377,463 | | | | | | Claudia Fan Munce | | $ | 103,406 | | | $ | 159,963 | | | $ | 263,369 | | | | | | Thomas C. O’Brien | | $ | 121,303 | | | $ | 159,963 | | | $ | 281,266 | | | | | | Vikrant Raina | | $ | 92,500 | | | $ | 159,963 | | | $ | 252,463 | | | | | | J. Michael Shepherd | | $ | 54,227 | | | $ | 149,629 | | | $ | 203,856 | | | | | | Jaynie Miller Studenmund | | $ | 97,500 | | | $ | 159,963 | | | $ | 257,463 | | | | | | David F. Walker | | $ | 125,000 | | | $ | 159,963 | | | $ | 284,963 | | | | | | Mary Lee Widener | | $ | 95,000 | | | $ | 159,963 | | | $ | 254,963 | |

| (1) | The amounts shown reflect the aggregate grant date fair value of stock awards granted in 2019 computed in accordance with the Financial Accounting Standards Board’s Accounting Standards Codification Topic 718, Compensation-Stock Compensation. We value the RSUs as of the grant date by multiplying the closing price of our common stock on that date by the number of RSUs awarded. The stock awards were granted on April 30, 2019 to eachnon-management director, other than for Mr. Shepherd, who received his grant on June 21, 2019. |

| (2) | The aggregate numbers of RSUs held by each currentnon-management director as of December 31, 2019 were as follows: |

| | | | | | Name | | Restricted Stock Unit Awards (#) | | | J. David Chatham | | | | 3,939 | | | | Douglas C. Curling | | | | 3,939 | | | | John C. Dorman | | | | 3,939 | | | | Paul F. Folino | | | | 3,939 | | | | Claudia Fan Munce | | | | 3,939 | | | | Thomas C. O’Brien | | | | 3,939 | | | | Vikrant Raina | | | | 3,939 | | | | J. Michael Shepherd | | | | 3,442 | | | | Jaynie Miller Studenmund | | | | 3,939 | | | | David F. Walker | | | | 3,939 | | | | Mary Lee Widener | | | | 3,939 | |

As described in the Compensation Discussion and Analysis, Pay Governance served as independent compensation consultant for the Compensation Committee for 2019 and will continue to advise on the compensation of our directors for 2020. During 2019, as part of its engagement with the Committee, Pay Governance: Table

provided advice on the selection of Contentsa peer group of companies for director compensation comparison purposes; provided guidance on industry best practices and emerging trends and developments in director compensation; reviewed director compensation; and provided advice on determining the structure and amounts payable under our director compensation program. The Compensation Committee reviews and recommends to the Board the form and level of director compensation. In December 2019, the Compensation Committee reviewed the Directors’ Compensation Policy and recommended one change for 2020 with respect to the annual cash retainer for ournon-management Chairman of the Board (increase to $120,000 from $100,000); the Board affirmed the recommendation of the Compensation Committee. The table below describes the components of thenon-management director compensation program in effect during 2019: | | | | | Compensation Element | | 2019 | | | | Annual Retainer —Non-Management Director (1) | | $ | 80,000 | | | | | Annual Equity Compensation — RSUs (2) | | $ | 160,000 | | | | | Annual Retainer —Non-Management Board Chairman | | $ | 100,000 | | | | | Annual Retainer — Committee Chairs (1) | | | | | | | Audit Committee | | $ | 25,000 | | | | Compensation Committee | | $ | 20,000 | | | | Nominating and Corporate Governance Committee | | $ | 15,000 | | | | Strategic Planning and Acquisition Committee | | $ | 12,500 | | | | | Annual Retainer — Committee Members (1) | | | | | | | Audit Committee | | $ | 15,000 | | | | Compensation Committee | | $ | 10,000 | | | | Nominating and Corporate Governance Committee | | $ | 7,500 | | | | Strategic Planning and Acquisition Committee | | $ | 5,000 | | | | | Fee for attendance of Board and Committee Meetings in Excess of Designated Number (3) | | $ | 2,000 | |

| (1) | Committee chair retainer represents amounts paid to each committee chair for their service in addition to the committee member annual retainer. Fees are paid in cash in equal quarterly installments. Fees are paidpro-rata for directors joining the Board after the payment date. |

| (2) | The award is granted and priced on the day of our annual meeting or, in the event of anout-of-cycle annual meeting, such earlier date as may be approved by the Board, and vest on the first anniversary of the grant date (or the day prior to the date of the annual meeting in the year following the year of grant, if earlier). Vesting of the award will accelerate upon death, disability, retirement from the Board or a change in control. Directors joining the Board after the date of the Annual Meeting will receive a pro rata annual RSU award on the date the director joins the Board, which will vest on the same terms as the other annual RSU awards. |

| (3) | Meeting fees paid only for meetings in excess of eight meetings of the Board, Audit Committee and Compensation Committee, and in excess of four meetings of the Nominating and Corporate Governance Committee and Strategic Planning and Acquisition Committee. Fees are paid in cash in connection with each such additional meeting. Directors may also elect to defer payment of their RSUs under the Outside Director Deferral Program. RSUs deferred under such program will generally be paid, subject to the applicable vesting requirements, in shares of the Company’s common stock on the earlier of (1) the director’s death or separation from service or (2) a change in control of the Company. |

Director Share Ownership Guidelines We require ournon-management directors to own a fixed amount of Company stock. The guidelines are based on a multiple of the annual retainer and require a value of at least $400,000 be held by each director. Directors have five years from their date of election to the Board to reach the ownership requirement. All Company securities owned outright or earned and subject only to time-based vesting restrictions, including deferred awards, are credited toward the requirement. All directors have met these requirements within five years of joining. EXECUTIVE OFFICERS Set forth below is information regarding our current executive officers. Our executive officers are appointed annually by the Board. | | | | | Frank D. Martell | | Age 60 | | |

| |

| |

| |

|

|---|

| | | | | | | | | Frank D. Martell |

| |

|

|

President and Chief

Executive Officer (1) |

|

Biography is set forth under the heading Proposal 1 — 1—Election of Directors

above. |

|

| | | Age: 57 | | | | | James L. Balas | | | | | | Age 49 |

(1)Mr. Nallathambi, the Company's former President and Chief Executive Officer, was granted a temporary leave of absence on February 13, 2017 and passed away on March 2, 2017. Effective March 6, 2017, the Board appointed Mr. Martell to the position of President and Chief Executive Officer and principal executive officer.

| | | | | | |

| |

| |

| |

|

|---|

Chief Financial Officer | | | | | | | | | JamesMr. Balas |

| |

|

|

|

|

Business Experience |

|

|

|

|

|

|

CoreLogic, Inc. |

|

| | | | | -

has served as the Company’s Chief Financial Officer (2016-present)

-

Senior Vice President, Finance and Controller (2012-2016)

-

since April 2016. Mr. Balas joined CoreLogic in March 2011, as Senior Vice President, Controller (2011-2012) Ameron International,and principal accounting officer. In 2012, his role expanded to include oversight of finance in addition to his other responsibilities. Prior to joining the Company, Mr. Balas held a manufacturervariety of productssenior finance leadership positions at several publicly-traded companies after a successful10-year career at Ernst & Young and materials for the

chemical, industrial, energy, transportation and infrastructure markets

-

Vice President and Corporate Controller (2009-2011)

Capgemini. | | | Barry M. Sando | | Chief Financial Officer | | | Age 60 | | | Managing Director, Underwriting and Workflow Solutions | | Mr. Sando has served as the Company’s Managing Director of Underwriting and Workflow Solutions (and predecessor business segments) since June 2010, when we became a stand-alone public company. Mr. Sando has more than 30 years’ experience in the housing finance and property information business and previously served in various executive positions with our predecessor company, FAC. | | | | | Age: 46 | | Various finance leadership roles:

-Francis Aaron Henry

Solar Integrated Technologies (2006-2009)

-

Keystone Automotive Industries (2003-2006)

-

Cap Gemini (2000-2003)

-

Ernst & Young (1993-2000)

| | |

|

|

|

|

Board and Council Service

Public Board Service |

|

Age 54 |

|

|

|

|

Symbility Solutions Inc., a TSVX listed provider of insurance claims solutions for

the property and health market verticals based in Toronto, Canada

(2014-present) |

|

| | | | | | | |

Table of Contents

| | | | | | |

| |

| |

| |

|

|---|

| | | | | | | | | Barry M. Sando |

| |

|

|

|

|

Business Experience

CoreLogic, Inc. |

|

| | | Senior Executive Vice

President, Group

Executive, Risk

Management and

Workflow | | -Chief Legal Officer

Senior Executive Vice President, Group Executive, Risk Management and

Workflow (2014-present)

Corporate

-Secretary

Group Executive and Executive Vice President, mortgage origination

services, default services and business and information services segments

(2010-2014)

| | |

|

|

Age: 57 |

|

The First American Corporation ("FAC"), our predecessor |

|

| | | | | -

President, informationMr. Henry has served as the Company’s Chief Legal Officer and outsourcing solutions business segment

(1997-2010)

-

Flood zone certification subsidiary

President (1997)

Executive Vice President (1995-1997)

-

Tax service subsidiary (1991-1995)

| | | | | | | | | |

| | | | | | |

| |

| |

| |

|

|---|

| | | | | | | | | Stergios Theologides |

| |

|

|

|

|

Business Experience

CoreLogic, Inc. |

|

| | | | | -

Senior Vice President,Corporate Secretary since November 2019. Prior to joining the Company, he was General Counsel and Corporate Secretary (2010-present)

| | |

|

|

|

|

FAC |

|

| | | Senior Vice President,

at MoneyGram International from 2012 to September 2019, and previously served as SVP, Assistant General Counsel, and

Secretary | | -

Senior Vice PresidentGlobal Regulatory and General Counsel, Information Solutions Group

(2009-2010)

Morgan Stanley

-

Executive Vice PresidentPrivacy Officer from 2011. Prior to MoneyGram, Mr. Henry served in various legal roles at The Western Union Company and General Counsel, U.S. Residential Mortgage

businesses, overseeing legal, compliance, operational risk, fraud prevention,

quality assurance and consumer and community affairs for Morgan Stanley's

mortgage origination and servicing platforms (2007-2009)

| | | | | Age: 50 | | | | | | | | | New Century Financial Corporation | | | | | | | -

Executive Vice President and General Counsel, overseeing legal, compliance,

privacy, security, consumer relations and government affairs (1998-2007).

New Century filed for bankruptcy protection in 2007 and was ultimately

liquidated

| | |

|

|

|

|

O'Melveny & Myers LLP |

|

| | | | | -

Corporate and securities practice (1992-1996)

| | |

|

|

|

|

Board and Council Service

Prior Council and Industry Association Service |

|

|

|

|

|

|

Federal Reserve Board's Consumer Advisory Council |

|

| | | | | | | First Data Corporation. |

Table of Contents

COMPENSATION DISCUSSION & ANALYSIS COMPENSATION DISCUSSION & ANALYSIS |

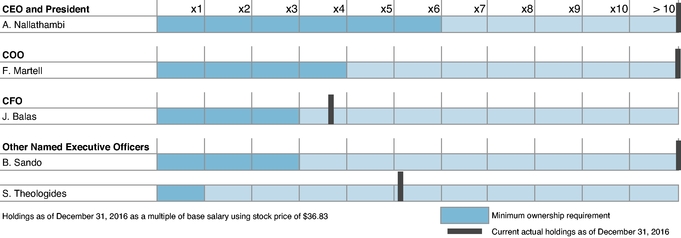

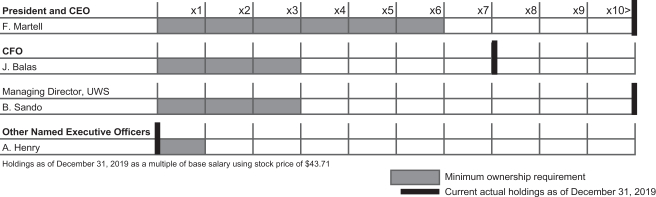

This Compensation Discussion and Analysis (CD&A)(“CD&A”) describes our compensation program, including our compensation strategy, philosophy, polices, programs and practices (our compensation program) for our named executive officers (NEOs)NEOs and the positions they held in 2016.2019. For purposes of this CD&A, the Committee refers to the Compensation Committee of our Board of Directors. | | | | | | | | |

| |

| |

| |

| |

|

|---|

| | | | | | | | | Named Executive Officer | | Named Executive Officer | | | | Position as of December 31, 2016(1) | | 2019 | | | | | | | | | | | | Anand Nallathambi | | Frank D. Martell | | President and Chief Executive Officer | | | | | | | | | | | | | | Frank D. Martell | | | | Chief Operating Officer | | | | | | | | | | | | | | James L. Balas | | | | Chief Financial Officer | Barry M. Sando | | Managing Director, Underwriting and Workflow Solutions | Francis Aaron Henry | | Chief Legal Officer and Corporate Secretary(1) | Arnold Pinkston | | | | | | Former Chief Legal Officer and Corporate Secretary(2) |

| | (1) | Barry M. Sando | | | | Senior Executive Vice President, Group Executive, Risk Management and Workflow | | Mr. Henry joined CoreLogic on November 6, 2019. | | | | | | | | | |

| | (2) | Stergios Theologides | | | | Senior Vice President, General Counsel and Secretary | | | | | | | | | | | |

(1)Mr. Balas was promoted to Chief Financial Officer on April 8, 2016. Mr. Nallathambi was granted a temporary leave of absence on February 13, 2017 and passed away on March 2, 2017. Mr. Martell was appointed President and Chief Executive Officer effective March 6, 2017.

Selected 2016 Business HighlightsMr. Pinkston left CoreLogic on June 14, 2019.

|

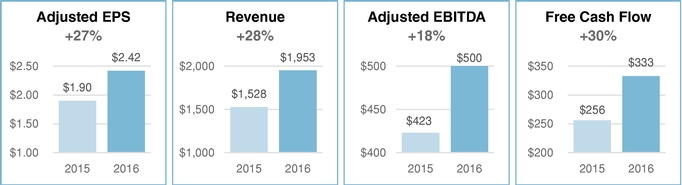

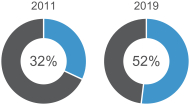

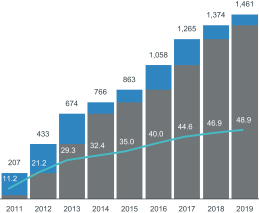

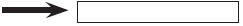

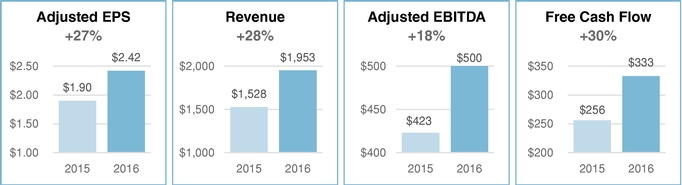

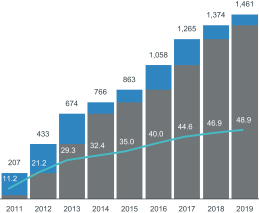

2019 BUSINESS HIGHLIGHTS Our compensation program is designed to align the interestinterests of our executive officers with those of our stockholders through executionuse of a balance of financial results and strategic objectives in three areas of strategic focus:focus that are intended to drive our long-term performance: growth and scale,innovation, operational excellence, and high performing organization. A significantorganization. In 2019, a majority of our NEOs'NEOs’ compensation is dependentcontinued to be based upon our financial performance and execution ofagainst these strategic priorities. Our 2016 financial success isobjectives. In setting our 2019 performance goals, we considered various factors including strategic initiatives associated with the direct resultimplementation of our abilitylong-term plans, programs required to provide clients with data-drivenensure robust cyber and information security and technology platforms and hiring and retaining the best available human capital, and the Company’s environmental, social and governance (ESG) initiatives. We also considered factors such as anticipated volatility and unpredictability in our domestic and international markets. We delivered strong operating and financial results in 2019. Significant strategic and operational highlights included: Enhancing business mix by increasing contributions from higher margin platform and recurring revenue streams and exit/wind down of non-core mortgage technology and default services units. Increasing non-US mortgage volume sensitive solutions to improve underwriting decisions, manage risks,almost 40% of total revenues, reflecting strong progress toward long-term goals. Acquiring and/or integrating important business streams to augment and capitalize on developing business opportunities.grow our insurance and spatial solutions, tax services and real estate marketing services operations. | | | | | | | | | | | | Since 2011, we grew revenues at an annual

compounded rate of 12%, adjusted EBITDA by

15%, and adjusted EPS by 31%

|

| | | | | | |

We achieved strong results in 2016. HighlightsCompleting the transformation of our 2016 operating results comparedAMC operation to 2015 includeenhance future growth and profitability.

Investing in new technology and data-related capabilities with a focus on data structures, visualization, technology platforms and advanced automation techniques. Progressing the following:

Tablemigration of Contents

Please see Appendix A for a detailed reconciliation of adjusted EBITDA, adjusted EPS and free cash flow (FCF)our technology stack to the most directly comparable GAAP financial measures.Google Cloud.

We also invested for our long-term growth in 2016 while returning substantial capital to stockholders in the form of share repurchases of approximately 6% of total shares outstanding.

| | | | | | | | | | | | We returned $195 million to stockholders and

reduced our outstanding share count by

5 million shares, or 6%

|

| | | | | | |

We accomplished key operational improvements in 2016. In addition to our solid financial results, we successfully achieved a number of key operational goals in 2016 that will enable future success, including:

➢We exceededExceeding our cost reduction targettargets through a reduction in organizational complexity, refining and automating work processes, and shrinking our real estate footprint, all of which contributed to expanded operating margins.

➢We drove strong organic growth in

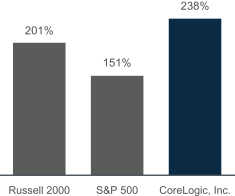

Long-term Financial Highlights Through 2019 Operating Performance – 2011 (first full year as a public company) – 2019 Growth

Adjusted EBITDA to Free Cash Flow (FCF) Conversion Percentage

| | | Shareholder Capital Returns ($millions)

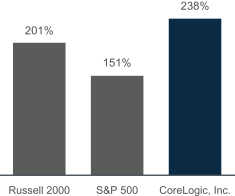

| | Stock Price Performance – 2011 - 2019

|

∎ Periodic ∎ Prior Cumulative ∎ Cumulative # of Shares Purchased 2019 FINANCIAL HIGHLIGHTS Revenues of $1.762 billion, an increase of 3% before the impact of foreign currency translation, our Risk ManagementAMC transformation and Workflow (RMW) segment, primarily through share gains, price increasesthe exit/wind down ofnon-core mortgage technology and growth in new product sales.

➢Wedefault services units.Adjusted EBITDA increased to $498 million, an increase of $5 million above 2018 levels. Adjusted EPS of $2.83 grew revenue significantlyby 4% compared to the prior year. Adjusted EBITDA margins up 70 basis points to 28%. Adjusted EBITDA exceeded 30% for the second half of 2019, including margin expansion of approximately 500 basis points in the Property Intelligence (PI) segment, primarilyfourth quarter. Cost management and productivity benefits of more than $20 million. Including heightened reinvestment in growth generating initiatives and productivity programs, FCF of $257 million was generated for the twelve months ended December 31, 2019. Repurchased approximately 3% of our common shares and reduced debt levels by $110 million. Initiated and declared our first quarterly dividend in December 2019 and paid in January 2020. Company share price increased more than 30%. We attribute these results to management’s ability to successfully implement our long-term strategic initiatives and tactical business plans and navigate a large and complex market undergoing heightened levels of volatility while maintaining focus in a challenging business environment, with strong leadership from Mr. Martell. Please seeAppendix A for a detailed reconciliation of adjusted EBITDA and FCF to the most directly comparable GAAP financial measures. EXECUTIVE COMPENSATION HIGHLIGHTS We aligned annual incentives to strong financial results. Our underlyingpay-for-performance approach is intended to reward management appropriately for results relative to targeted performance through use of a weighted combination of three performance metrics: revenue, adjusted EBITDA, and FCF. Annual incentive performance goals were set at the launchbeginning of 2019 based on best available market forecasts at the time, which called for a modest decline relative to actual 2018 for US mortgage market unit volumes. In addition, our financial targets were set based on our assessment of the Valuation Solutions Group (VSG).

➢impact of key strategic initiatives as well as known or anticipated macro-economic environment and operating conditions in the global markets we serve. We achieveddelivered a company-wide organic growth rate of 5%.

➢We simplifiedstrong performance in 2019 – both operationally and financially – exceeding our capital structure, which provided both additional financial flexibilityrevenue target by 10%, our adjusted EBITDA target by 11%, and a significant reduction in borrowing costs.

Executive Summary of 2016 Compensation

|

Our compensation program rewarded strong financial results. Our 2016 financial performance exceeded targets and resulted in above-target payouts. Resultsour FCF target by 4%. Combined results for revenue, adjusted EBITDA, and free cash flowFCF generated annual incentive funding at 141% of target. The overachievement against our targets was driven principally by a combination of effective and aggressive management, improved market conditions for US mortgage as well as changes in the timing related to our AMC transformation program and the wind down of certainnon-core platforms. After considering the impact of changes in the timing and other assumptions related to our AMC transformation program as well as the wind down ofnon-core platforms on actual financial results against targeted performance levels, the Committee exercised its discretion to reduce final funding of the ICP (ourfinancial results to 128.7% of target.

We assessed and rewarded our most significant strategic accomplishments. For our NEOs, 25% of annual cash bonus plan) at 146%incentive awards is tied to performance on predetermined strategic objectives as well as specific goals tied to employee satisfaction and information security.Based on overall strong strategic accomplishments in a challenging revenue environment as well as achievement of target. Notwithstanding these strong results, managementemployee satisfaction and information security related targets, and individual contributions to those accomplishments, the Committee reduced bonus payouts by 5%. Despite our strong financial results and above-target payout, management recommended and the Committee approved a reduction in ICP funding by 5% across the enterprise because acquisition-related assumptions used in setting target performance did not meet timing expectations. This reduced the calculated bonus to 139% of target. In addition, the payout for the strategic goals portion of the ICP, relative to the funded amount, was increased for one NEO, reduced for one NEO, and unchanged for three NEOs. Finally, results for adjusted EPS and our three-year total stockholder return (TSR) relative to our peer group generated a payout of 124.5% in our long-term performance share plan for 2014-2016.

No across the board increase in base salaries for 4thconsecutive year. Notwithstanding strong operating results, consistent with our practices in recent years, the Committee did not increase NEO base salaries for 2016, except for Mr. Balas in consideration of his promotion to Chief Financial Officer.

Table of Contents

Our compensation program also rewarded our many strategic accomplishments. The chart below highlights accomplishments in 2016 acrossawarded our three eligible NEOs that were with us at the end of 2019 from 129% to 170% of target for strategic focus areas:objectives.

| | | Strategic Focus | | 2019 Accomplishments | Growth and Innovation | | ✓ Achieved positive underlying growth (normalizing for AMC transformation program and wind down ofnon-core platforms mentioned previously) and enhanced business mix of higher margin platform-related businesses including insurance and spatial solutions, real estate, and commercial tax servicing ✓ Increased contributions fromnon-US mortgage sensitive businesses to approximately 40% of total revenues ✓ Out-performed US mortgage market volume trends in property tax payment processing, flood zone determination and collateral valuation platforms units ✓ Expanded market share through product introduction and enhancements as well as deployment of integrated solutions packages and pricing gains ✓ Completed transformation of our AMC operation to a premium service offering which is expected to improve quality and productivity and generate accelerated growth and higher margins in 2020 and beyond ✓ Invested in strategic cutting-edge data and technology-related enhancements, artificial intelligence, and visualization to enhance future growth and offering capabilities | Operational Excellence | | ✓ Active-active Google Cloud Platform (“GCP”) operating model deployed, and migrated significant systems and applications to the GCP to further enhance technology infrastructure capabilities and efficiencies ✓ Exceeded productivity savings target of $20 million through automation, outsourcing and partnerships, real estate consolidation and other workflow enhancements ✓ Expanded adjusted EBITDA margins by 70 basis points for the full-year to 28%; adjusted EBITDA margins exceeded 30% during the second half of 2019, significantly ahead of targeted levels and the same 2018 period ✓ Generated strong operating cash flow, which facilitated heightened investment levels, debt reduction of approximately $110 million, the repurchase of 3% of shares outstanding, and the initiation of a quarterly dividend ✓ Amended our credit facility at more favorable terms, extended maturity and increased financial flexibility |

| | | | | | | | |

| |

| |

| |

| |

|

|---|

| | | | | | | | | Strategic Focus | | Strategic Focus | | | | 20162019 Accomplishments |

| | | | | | | | | | | | | Grow and

Scale | | High Performing Organization | | ü✓ Launched higher impact Leadership Principles Framework and expanded leadership development programs; expanded succession planning

Grew revenue 28%, driven by double digit growth✓ Achieved a 10% increase in the PI segment and strong organic growth in the RMW segment

employee engagement scores

ü✓

Strengthened new product pipeline Expanded ESG programs with high potential products and made significant progress on generating sales from newer product launches demonstrated by our solid organic growth rate in the second half of 2016

ü

Launched the VSG and outlined strategic plan and solutions roadmap, achieving all integration milestones

| | | | | | | | | | | | | | Operational

Excellence | | | | ü

Exceeded our $30 million cost reduction target by consolidating facitlities, reducing staff costs, outsourcing certain business activites, and delivering on other operational improvements

ü

Advanced innovation and technology transformation through expansion of CoreLogic Labs

ü

Completed refinancing and bond redemption, resulting in significantly lower borrowing costs and greater financial flexibility

| | | | | | | | | | | | | | High Performing

Organization | | | | ü

Launched core Centers of Expertise to elevatea focus on client service,education and financial literacy and community development

✓ Enhanced compliance and information security organizations and capabilities and exceeded key cyber security-related performance targets ✓ Hired key talent in sales and marketing, and upgraded tools and capabilities while continuing the transformation of shared services functions by investing in automation and standardization to drive productivity, quality, and delivery

efficiency ü✓

Established landmark state-of-the-art hub facility in Dallas, Texas, bringing together representatives across all operating units to drive innovation, collaboration and service excellence

ü

Simplified our organization model, making it easier to do business with CoreLogic

| | | | | | | | | | | |

2016 Say on Pay Vote and Engagement with Our Stockholders Grew share price more than 30% during the 2019 calendar year

|

| | | | | | | | | | | | 97% stockholder support on our 2016 say on pay

|

| | | | | | |

We have had strong support from stockholdersStrong Stockholder Support on Say on Pay.Pay

Our Board and management are committed to maintaining sound and effective compensation and governance policies and programs designed to build value for our stockholders. At our 20162019 Annual Meeting, 97%nearly 96% of the votes cast were in favor of the advisory vote to approve our executive compensation.compensation paid in 2018. With this support in favor of our existing compensation program, absence of negative feedback from our stockholder outreach effort, and following its regular review of our practices, the Committee determined to maintaincontinue our 20162018 compensation program for 2017.in 2019 with only minor adjustments. We engageActive Engagement with Our Stockholders

The Board and executive management are committed to engaging with our major stockholders. Throughout the year, executive management proactively and periodically meets with current and prospective stockholders to discuss our strategic priorities, operational performance, and financial results. Also, through these discussions or separate outreach efforts, we seek to engage our top stockholders to solicit feedback on corporate governance, our compensation program, and related matters. In early 2017, as part of our stockholder engagement strategy,2019, we conducted such outreach to 20 of our top stockholders representing approximately 60% ownership. Our stockholder outreach includes ongoing discussions with manya majority of our investors and we often solicit their feedback on a variety of topics, including executive compensation. Theoutstanding shares; these stockholders we reached out to did not express concerns over our corporate governance practices or compensation program design. GOOD PAY GOVERNANCE PRACTICES The Committee oversees the design or practices. In addition to soliciting feedback from our stockholders, the Committee routinely assessesand administration of our compensation programsprogram and seeks toevaluates it against competitive practices, legal and regulatory developments and corporate governance trends. The Committee has incorporated the following governance features into our compensation program:

Table of Contents

| ✓ | Review total compensation relative to the median of a peer group of industry-aligned companies with similar executive talent needs |

maximize alignment between stockholder return and executive compensation while incentivizing and retaining a high-performing management team.

| ✓ | Tie annual incentives to achievement of multiple rigorous financial and operating goals |

| ✓ | Use performance-based vesting for 50% of long-term compensation, tied to achievement of stretch EPS targets and TSR relative to our peers |

| ✓ | Cap performance-based vesting of performance shares at 150% of target if3-year TSR ranks below 55th percentile of our peers |

| ✓ | Require achievement of threshold adjusted net income level to be eligible to vest in RSU awards |

| ✓ | Maintain robust stock ownership guidelines and require covered executives to retain 50% of netafter-tax shares earned until the guidelines are met |

| ✓ | Maintain a claw-back policy for incentive payments |

| ✓ | Use an independent compensation consultant retained directly by the Committee, in its sole discretion, who performs no consulting or other services for management |

| ✓ | Require double-trigger for accelerated vesting upon termination of employment following a change in control |

| ✓ | Assess annually potential risks relating to the Company’s compensation policies and practices |

| × | Incentivize participants to take excessive risks |

| × | Award bonuses to our executive officers outside of our ICP |

| × | Allow margining, derivative, or speculative transactions, such as hedges, pledges, and margin accounts, by all employees, including executive officers, and directors |

| × | Provide excessive perquisites |

| × | Provide excise taxgross-ups upon termination with a change in control or taxgross-ups for other compensation |

| × | Allow for repricing of stock options without stockholder approval |

| × | Pay Philosophy“single-trigger”change-of-control cash payments or have “single-trigger” equity vesting |

PAY PHILOSOPHY We pay for performance.Our compensation program is heavily weighted toward performance-based annual and long-term compensation that provides a direct link between rigorous goals for corporate performance and pay outcomes for our executive officers. Our annual incentive planICP also ties pay outcomes to the achievement of key strategic objectives that we believe will drive longer-term value to stockholders. We believe that our compensation program provides effective incentives for strong operating results by appropriately aligning pay and performance. Our philosophy is designed to: ➢Attract, motivate and retain highly-qualified executive officers critical to our long-term success;

➢Align the interests of our executive officers with the interests of our stockholders;

➢Reward executive officers for achieving pre-defined stretch financial goals and strategic objectives that may not yield current-period financial results but are expected to position us for enhanced results in future periods;

➢Encourage strategic long-term development and profitable investment in the business;

➢Motivate and reward appropriate but not excessive risk-taking to grow the business; and

➢Support pay practices with strong corporate governance and independent board oversight.

| | | Performance-Based

Compensation MixPhilosophy | | • Attract, motivate and retain highly-qualified executive officers critical to our long-term success • Align the interests of our executive officers with the interests of our stockholders • Reward executive officers for achievingpre-defined rigorous financial goals and strategic objectives that may not yield current-period financial results but are expected to position us for enhanced results in future periods • Encourage strategic long-term development and profitable investment in

the business • Motivate and reward appropriate risk-taking to grow the business • Support pay practices with strong corporate governance and independent board oversight | Compensation Program Primary Elements | | • Base salary • Annual cash incentive compensation plan awards • Long-term equity incentives • Other compensation (welfare, retirement, termination and other benefits) |

We have four elements of total compensation:

1Base salary

2Annual cash incentiveOur compensation plan (ICP) award

3Long-term equity incentives

4Other compensation (benefits and perquisites).

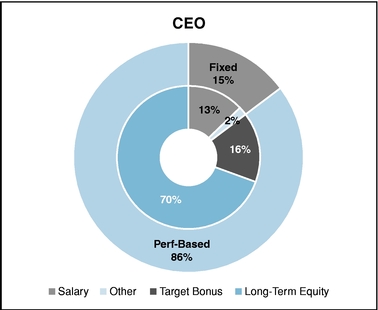

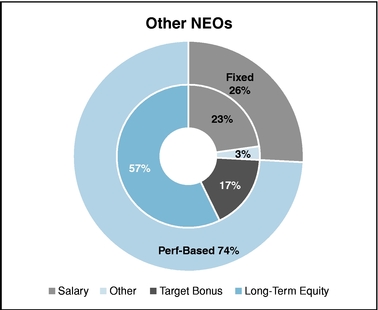

program emphasizes performance-based incentives.86% of our CEOCEO’s compensation and 74%75% of the compensation for the other NEOs (including Mr. Henry and excluding Mr. Pinkston) is performance-based. The chart below demonstratesillustrates our pay mix.

Table of Contents

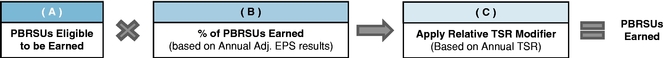

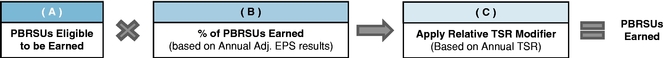

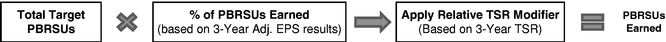

Performance-Vested Equity Awards. In 2016, 50% of (For these purposes we have determined compensation by using the targetgrant date fair value of our long-term incentiveequity awards forand by valuing our CEO and other NEOs was granted in the form of performance-based restricted stock units ("PBRSUs"(“PBRSUs”) that vestat target level of performance.)

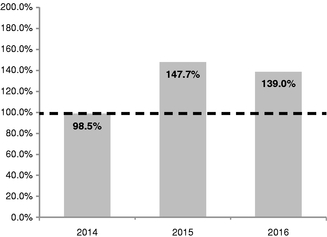

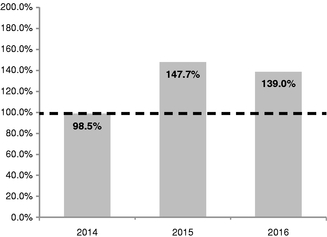

We focus on long-term stockholder value. As illustrated above, nearly 70% of the total compensation opportunity for our CEO is based on adjusted EPS results relativeachievement of stockholder-aligned performance and the value of our shares. For other NEOs, half of their total target compensation opportunities are tied to target and TSR relative to the companies in our peer group (see description of the peer group later in this section). The remaining 50% of target value was granted in the form of time-vested restricted stock units ("RSUs") that require us to achieve a threshold adjusted net income level in order to be eligible to vest.these stockholder results. Use of Rigorous Goals in Our Incentive Plans.We set challenging goals for both our annual incentive and long-term equity plans. The chart below demonstrates the variance in payouts since 2014, outcomes that reflect our payincrease base salaries primarily for performance approach to compensation. Because acquisition-related assumptions used in setting target performance did not meet timing expectations, management recommended and the Committee approved a 5% decrease in the 2016 ICP pool on an enterprise basis. This reduced the overall calculated bonus from 146% to 139% of target.

NEO ICP Corporate Financial Funding as a

% of Target

or promotion.3 Year Overview

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Performance vs. Budget (% of Target) | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2014 | | | | 2015 | | | | 2016 | | | | | | | | | | | | | | | | | | | | | | | | Revenue | | | | 99% | | | | 102% | | | | 106% | | | | | | | | | | | | | | | | | | | | | | | | Adjusted EBITDA | | | | 87% | | | | 107% | | | | 102% | | | | | | | | | | | | | | | | | | | | | | | | Free Cash Flow | | | | 134% | | | | 144% | | | | 132% | | | | | | | | | | | | | | | | | | | | |

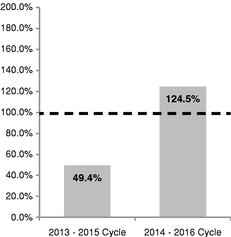

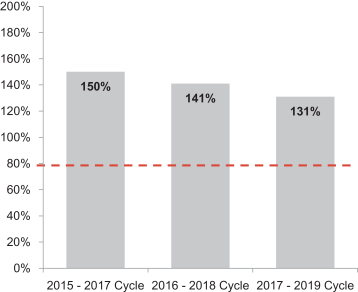

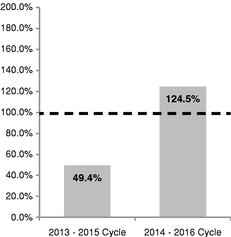

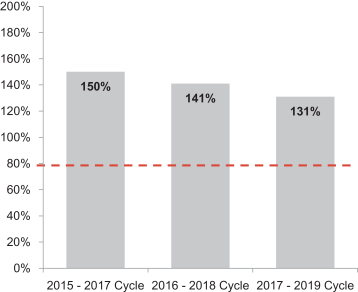

Long-term Incentives. Payouts under our PBRSU awards also illustrate our use of rigorous performance targets and our adherence to pay for performance. Because we had a sub-optimal result on adjusted EPS in 2014, the 2013 PBRSU award (with a 2013-2015 performance period) paid out at less than half of target value. In contrast, the 2014 PBRSU award (with a 2014-2016 performance period) paid out at 124.5% of target based on particularly strong results in 2015 and 2016.

Table of Contents

Average NEO PBRSU Payout as a %

of Target

2 Performance Cycle

(4-Year) Overview

No Base Salary Increases Each Year.Our practice is to benchmark compensation annually but to increase an NEO'sNEO’s base salary only when warranted by sustained performance, an increase in the scope of responsibilities or significant gaps to competitive pay levels. Only Mr.Of our currently employed NEOs, only Messrs. Martell and Balas received a base salary increase in 2016 in consideration of his appointment to Chief Financial Officer. In light of anticipated mortgage market headwinds in 2017, the Committee decided that all NEOs will forego base salary increases in 2019 to recognize performance and move their respective salaries to more competitive levels.

We set rigorous goals in our incentive plans. We set challenging goals for 2017, except for Mr. Martell whose salary was increasedboth our annual incentive and long-term equity plan, with recognition of the broader macro-economic environment factored into performance goals. We outperformed US mortgage market trends and delivered single-digit top line growth in connection with his promotion to Presidentour core operations, resulting in year-over-year growth in adjusted EBITDA and Chief Executive Officer in March 2017.FCF despite very challenging market conditions as we entered the year. For 2019, we also considered the impact of the timing of significant planned investments on our results. Use of Strategic Goals in Our ICP. The achievement ofWe use strategic goals representsin our ICP.Results on strategic goals represent 25% of the annual ICP opportunity for our executive officers. We believe this approach rewards the accomplishment of key objectives that will drive future performance. The strategic goals portion is funded by the results on financial goals. The Committee separately determines the portion of the funded amount that should be paid as a result of achievement of the individualassigned objectives. The Committee carefully evaluates management'smanagement’s accomplishments relative to the goals, as further described below.

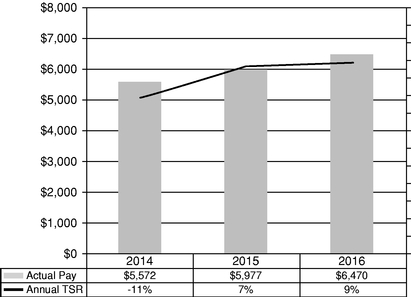

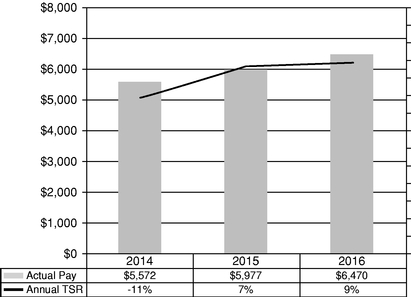

Our equity grants are tied to performance.In 2019, 50% of the target value of our long-term incentive awards for our CEO pay is aligned to stock price performance. The alignment of CEO total direct compensation (base salary, ICP and LTI) and our TSR over the past three years, depictedother NEOs was granted in the table below, demonstrates alignmentform of CEO actual pay withPBRSUs that vest based on achievement of adjusted EPS results for stockholders. These pay amounts do not include changerelative to target and TSR relative to the companies in pension value or "All Other Compensation"our Peer Group (as described and defined later in this section). We set rigorous goals in our PBRSU awards, where strong operating and shareholder performance, such as a 31% shareholder return in 2019, has allowed us to achieve above-target payouts in the 2016 Summary Compensation Table below.

Tablelast three award cycles. The remaining 50% of Contents

CEO Compensation-TSR Alignment

Table of Contents

Pay Program Design and Practices

|

We employ good governance practices. The Committee oversees the design and administrationtarget value of our compensationlong-term incentive awards was granted in the form of RSUs that require us to achieve a threshold adjusted net income level in order to be eligible to vest.

3-Year PBRSU Payouts

2019 COMPENSATION PROGRAM OVERVIEW The following table describes each aspect of our pay program and evaluates it against competitive practices, legal and regulatory developments and corporate governance trends. The Committee has incorporated the following leading governance features into our compensation program:for executive officers. | | | | | | | | | | | | | | | | | | | | What We

Do

|

| | | ✓

Review total compensation relative to median of a peer group of industry-aligned companies with similar executive talent needs

✓

Tie annual incentives to achievement of multiple stretch financial and operating goals

✓

Use performance-based vesting for 50% of long-term compensation, tied to achievement of stretch EPS targets and total stockholder return (TSR) relative to our peers

✓

Maintain robust stock ownership guidelines

✓

Maintain a clawback policy for incentive payments

✓

Use an independent compensation consultant retained directly by the Committee, in its sole discretion, who performs no consulting or other services for the Company's management

✓

Require double-trigger for accelerated vesting upon termination of employment following a change in control

✓

Assess annually potential risks relating to the Company's compensation policies and practices

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | What We

Don't Do

|

| | | ✗

Incentivize participants to take excessive risks

✗

Award discretionary bonuses to our executive officers

✗

Allow margining, derivative, or speculative transactions, such as hedges, pledges, and margin accounts, by executive officers

✗

Provide excessive perquisites

✗

Provide excise tax gross-ups upon termination with a change in control or for other awards

✗

Allow for repricing of stock options without stockholder approval

✗

Pay "single-trigger" change-of-control cash payments or have "single-trigger" equity acceleration

| | | | | | | | | | | |

Table of Contents

2016 Compensation Program Overview

|

The following table describes our pay program including the role and purpose for each aspect of it.

| | | | | | | | | | | | | | | | | | | | | | | | ELEMENT | | DESCRIPTION | | ROLE AND PURPOSE |

| | | | | | | DESCRIPTION | | | | | ROLE AND PURPOSE | | | | | | | | | | | | REWARDS STRATEGY | | | | | | Review target total pay relative to market median and determine individual pay based on experience and performance

Tie approximately 75% or more of NEO target pay opportunity to operating results and share price performance | | | | ProvideProvide market-competitive mix of base salary, cash incentives and equity incentives Aligns

Align compensation to results for our stockholders | | | | | | BASE SALARY | |

|

|

| | Competitive fixed compensation Base salary increased primarily for sustained performance or promotions | | | | | | | | | | | | | BASE SALARY | | Competitive fixed compensation

Limited increases since 2011

No base salary increase for CEO since 2011

| | ProvidesProvide competitive level of fixed pay to attract, motivate and retainhighly-qualified executives Increases generally provided only

Control fixed costs and emphasize pay for role expansionperformance through limited salary increases | | | | | | ANNUAL INCENTIVE COMPENSATION PROGRAM (ICP) | | | | | | Base incentives on performance against rigorous targets for revenue, adjusted EBITDA, FCF and strategic goals | | | | Motivate and reward achievement of key financial goals and strategic accomplishments that drive long-term stockholder value | | | | | | LONG-TERM EQUITY INCENTIVES | | | | | | Performance- Based Restricted Stock Units (PBRSUs) | | | | | | | | | ANNUAL INCENTIVE

PROGRAM (ICP) | | Annual cash incentives based on performance against established targets for revenue, adjusted EBITDA, cash-flow and strategic goals | | Motivates and rewards executives for achievement of key financial results and strategic accomplishments that drive stockholder value | | | | | | | | | | | | | | | | LONG-TERM | | Performance-

Based Restricted

Stock Units

(PBRSUs) | | 50% of 20162019 total LTI grant value for executive officers Shares earned based on 3 years of adjusted EPS performance, modified by TSR relative to our peers | | Focuses | | Focus and rewards executives onreward for achievement of operating results over the long term

Use of operating results and relative TSR ensures alignment of payouts with our performance relative to the broader market EPS growth historically has been highly aligned with our share price | | | | | | | | | | | | INCENTIVESRestricted Stock Units (RSUs) | | | | | | | | | | | | | | | Restricted Stock

Units (RSUs) | | 50% of 20162019 total LTI grant value for executive officersGrants vest ratably over three years

Requires achievement of threshold operatingadjusted net income goal to be eligible for vesting | | Enhances | | Enhance retention of key talent Value at vesting based on stockshare price, which aligns executives with stockholdersstockholders’ interests | | | | | | | | | | | | | | | | | | RETIREMENT PROGRAMS | | | | | | | | | | | | | | | | | RETIREMENT PROGRAMS | | 401(k) program for all employees

Legacy supplemental executive retirement plan frozen in 2010 with no new entrants allowed Limited benefits available | | | | ProvideAligns with market-prevalent retirement programs Focuses

Focus executives on accumulating savings | | | | | | | | | | | | | | | | PERQUISITES | | Limited benefits available | | FocusesFocus executives on rewards fromvalue-creating activities | | | | | | | | | | | | PERQUISITES | | | | | | | | | | |

Table of Contents

Determining Pay Generally, in determining base salary, target annual ICP and guidelines for long-term equity awards, the Committee considers a number ofseveral factors including, but not limited to, the executive officer's:officer’s: ➢role, including the scope and complexity of responsibilities;

➢- responsibilities

experience and capabilities, including institituional knowledge;

➢- institutional knowledge

contributions or responsibilities beyond the typical scope of the role;

➢- role

individual performance;

➢comparisons withperformancepositioning relative to our other executive officers;

➢- officers

difficulty in recruiting a replacement;replacement, and

➢competitive compensation opportunities provided by our peers and other competitors for similar execuitive talent. executive talent Consideration of Prior Amounts Realized

|

Our philosophy is to incentivize and reward executive officers for future performance. While the Committee regularly reviews executive officer equity grants and vesting, it does not consider prior stock compensation gains (option gains or restricted stock awarded in prior years) in setting future compensation levels. Peer Group and Benchmarking Peer Group and Benchmarking

|

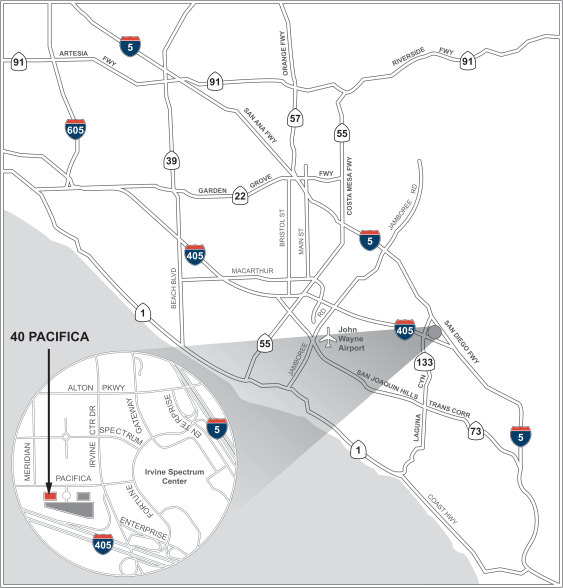

In order toTo monitor competitive compensation practices, the Committee relies primarily upon data compiled from public filings of selected companies (our peer group)“Peer Group”) that it considers to be competitors or appropriate comparators for executive talent. The Committee reviews and approves the Peer Group annually. Criteria for peer groupPeer Group selection include firms that operate in data, information and analytics and related businesses.as well as those that have a high degree of sensitivity to mortgage origination volumes. Our 2016 peer group2019 Peer Group is presented in the table below.

Historically, our peer group has been challenging to construct as there are few firms that operate with highly comparable business mixes. Peers have generally been information and service providers, with some financial technology firms also included. For 2019, the Company refreshed its peer group to provide greater alignment with businesses that are sensitive to mortgage origination volumes and interest rates. Table of Contents

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | CoreLogic 2016 Peer Group |

| | | | | | | | | | | | | | | Comparator Group Rationale |

| | | | Company | | | Revenue | | | Market Value | | | EBITDA Margin | | Comparable

Revenue Size |

| Comparable

Market Value |

| Data

Analytics |

| Direct Talent

Competitor |

| | | | | |

| ($MM)

|

|

| ($MM)

|

|

| (%) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Fidelity National Financial | | $ | 9,554 | | $ | 9,622 | | | 17 | % | | | | | ✔ | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | First American Financial | | $ | 5,576 | | $ | 3,904 | | | 11 | % | | | ✔ | | ✔ | | ✔ | | | | | | | | | | | | | | | | | | | | | | | | | | | | Equifax | | $ | 3,145 | | $ | 14,159 | | | 36 | % | ✔ | | | | | | ✔ | | | | | | | | | | | | | | | | | | | | | | | | | | | | Broadridge Financial Solutions | | $ | 2,897 | | $ | 7,708 | | | 20 | % | ✔ | | | | | | ✔ | | | | | | | | | | | | | | | | | | | | | | | | | | | | Gartner | | $ | 2,445 | | $ | 7,515 | | | 17 | % | ✔ | | | | ✔ | | ✔ | | | | | | | | | | | | | | | | | | | | | | | | | | | | Verisk Analytics | | $ | 1,995 | | $ | 13,592 | | | 50 | % | ✔ | | | | ✔ | | ✔ | | | | | | | | | | | | | | | | | | | | | | | | | | | | Dun & Bradstreet | | $ | 1,704 | | $ | 4,463 | | | 29 | % | ✔ | | | | ✔ | | ✔ | | | | | | | | | | | | | | | | | | | | | | | | | | | | DST Systems | | $ | 1,557 | | $ | 3,504 | | | 23 | % | ✔ | | ✔ | | | | ✔ | | | | | | | | | | | | | | | | | | | | | | | | | | | | Henry (Jack) & Associates | | $ | 1,355 | | $ | 6,884 | | | 35 | % | ✔ | | | | | | ✔ | | | | | | | | | | | | | | | | | | | | | | | | | | | | Neustar | | $ | 1,210 | | $ | 1,829 | | | 41 | % | ✔ | | ✔ | | ✔ | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Black Knight Financial Services | | $ | 1,026 | | $ | 2,612 | | | 43 | % | ✔ | | ✔ | | ✔ | | ✔ | | | | | | | | | | | | | | | | | | | | | | | | | | | | Fair Isaac | | $ | 881 | | $ | 3,844 | | | 23 | % | ✔ | | ✔ | | ✔ | | ✔ | | | | | | | | | | | | | | | | | | | | | | | �� | | | | | ACXIOM(1) | | $ | 880 | | $ | 1,666 | | | 14 | % | ✔ | | ✔ | | ✔ | | ✔ | | | | | | | | | | | | | | | | | | | | | | | | | | | | CSG Systems | | $ | 761 | | $ | 1,562 | | | 23 | % | ✔ | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Ciber(1) | | $ | 680 | | $ | 279 | | | -5 | % | ✔ | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | IHS(2) | | | — | | | — | | | — | | — | | — | | ✔ | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 75th Percentile | | $ | 2,671 | | $ | 7,611 | | | 35 | % | — | | — | | — | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | 50th Percentile | | $ | 1,557 | | $ | 3,904 | | | 23 | % | — | | — | | — | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | 25th Percentile | | $ | 954 | | $ | 2,220 | | | 17 | % | — | | — | | — | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | CoreLogic | | $ | 1,953 | | $ | 3,181 | | | 23 | % | — | | — | | — | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | Notes: | | | | | Data above reflects end of the most recently disclosed fiscal year. | | | | | (1) FY16 year-end financial results not yet released at the time of this report, Revenue & EBITDA data reflect 12-month trailing results. | | | | | (2) IHS completed a merger with Markit Ltd in July 2016. | | | | | | | | | | | | | | | | | | | | | | | | | |

The Commmitteefollowing organizations were added to the 2019 Peer Group: Fidelity National Information Services, Inc. Realogy Holdings Corporation Mr. Cooper Group, Inc. (formerly Nationstar Mortgage Holdings) PennyMac Financial Services, Inc. MGIC Investment Corporation Altisource Portfolio Solutions Three peers in the 2018 Peer Group were removed due to the Committee’s determination of industry or size misalignment: Broadridge Financial Solutions | | | | | | | | | | | | | | | | | | | | | | | | CORELOGIC 2019 PEER GROUP | | | | | | | | | | | | | | | | | | Comparator Group Rationale | | | | | | | | | | Company Name | | Revenue1 | | | Market Value (12/31/2019) | | | EBITDA

Margin1 | | | Comparable Revenue Size2 | | Comparable

Market Value2 | | Data

Analytics | | Mortgage Origination | | Direct